Despite the record-high global cocoa prices in April, Ghanaian cocoa farmers are finding it challenging to sustain themselves. Many farmers feel disheartened and hopeless due to the government’s local pricing system.

In the Afigya Kwabre district of Ghana’s Ashanti region, individuals like Kingsley Owusu are renowned for cultivating Ghana’s primary cash crop. Owusu and his community have dedicated over three decades to growing cocoa beans.

For years, the cocoa harvest supported Owusu in providing for his children, who have since grown into adulthood. However, now at 60 years old, Owusu is anxious about his own livelihood.

“My production levels have gone down because of climate change and diseases. And illegal mining activities are also contributing to this,” Owusu told DW, adding that he barely makes enough to get by.

Owusu used to produce about 10 bags of cocoa per season, but now he struggles to fill even three. As a result, he has far less cash in hand than he used to.

Ghana steps in to help cocoa farmers

The Ghana Cocoa Board (COCOBOD), which regulates the sector, recently announced that it would significantly increase what it pays cocoa farmers per ton.

COCOBOD said in a statement that “the increase in the producer price of cocoa has become necessary to enhance the income of cocoa farmers.”

From the previous rate of 20,928 Ghanaian cedis (€1,460/$1,557) per ton, it pledged an increase of nearly 60%, meaning it would pay farmers 33,120 cedis per ton moving forward. That translates to 2,070 cedis per bag of cocoa with a gross weight of 64 kilograms.

But farmers like Owusu have taken issue with the government’s new pricing policy.

Ghana’s cocoa farmers feel left out of decision-making

“Per the world price, we should be receiving more,” he told DW, highlighting that this month, the price of cocoa on the world market had reached $10,000 per ton.

The price of cocoa is primarily determined in commodity futures markets in New York and London, where supply and demand play significant roles.

However, the manner in which cocoa beans are traded differs based on varying standards in each country, particularly in Africa, where cocoa trading systems often exhibit substantial differences in their structures.

In Ivory Coast, for example, the leading producer on the continent, farmers can sell their beans to cooperatives they belong to or trade directly with private buying companies.

But in Ghana, the world’s second-largest exporter of cocoa, there is a long-established mechanism that limits farmers in a number of ways. They cannot trade with external buyers and thus lack control over their own pricing.

They can only sell their beans to the state agency COCOBOD, which then trades that product on the global market.

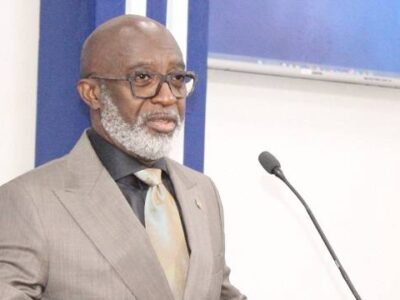

Moses Djan Asiedu, the board secretary of the West African Cocoa Farmers Organization, echoes the concerns raised by local farmers in Ghana. “COCOBOD is a price-maker, and the established price is beyond the control of the farmers. We believe that the mechanism determining the price is unfair,” he stated to DW.

Purpose of Ghana’s centralized cocoa market

In contrast, Fiifi Boafo, the spokesperson for COCOBOD, explained to DW that when cocoa prices rise on the global market, it does not necessarily translate to an immediate increase in income for farmers.

“The increment in price [changes] at the international market is something that we get excited about — excited because this provides farmers with opportunities to improve revenue,” he explained, adding that they deal in “forward sales” with farmers.

However, Ghana’s practice of forward-selling cocoa means that producers are dependent on the prices negotiated by the government, without having an independent voice in the process.

COCOBOD stated that this policy is designed to provide both the government and cocoa-producing farmers with collective control over supply and demand mechanisms in the commodities market. This approach aims to secure future cocoa supplies to mitigate risks associated with price volatility and to stabilize the market.

But Asiedu contends that this arrangement leaves cocoa-producing countries like Ghana vulnerable in securing equitable pricing for all stakeholders and insists that change is imperative. “There is no fairness. That is why COCOBOD also agrees to [accept] whatever is given,” he asserted.

Asiedu believes that local farmers in Ghana deserve to receive more than just a fraction of the price for which their beans are sold. He attributes the shortfall to government intervention in the production process, which he believes disadvantages producers.

“The government only [looks at] the cost involved in handling the cocoa before they offer a price for the farmers,” he told DW.

Boafo agreed that this policy of forward selling Ghana’s cocoa may not present farmers with opportunities to reap the full benefits of their output, especially now that prices are up on the world market.

However, he believes Ghana’s policy also has its benefits, and that is has protected farmers in the past by establishing reliable rates for their crops.

Are farmers facing an untamable market?

According to Asiedu of the West African Cocoa Farmers Organization, Ghana may be running out of time to salvage the cocoa sector. Numerous farmers are either abandoning their businesses or retiring without having anyone to inherit their farms.

“Most farmers, about 70%, are overaged. And they lack the strength to maintain their farms, especially if they do not get enough money … for their labor. So they abandon their farms,” Asiedu explained.

To halt this trend, both Ivory Coast and Ghana took an unusual step in 2019 to improve farmers’ living conditions. They declared that cocoa buyers would have to pay an additional premium of $400 per metric ton of cocoa beans purchased to compensate for the changing and aging cocoa labor market — the so-called living income differential.

However, a new study by the humanitarian organization Oxfam, released at the World Cocoa Conference, shows that this approach has failed, partly on account of the rising commodity prices.

But the policy also crashed in part because traders also pay a negotiated premium for cocoa based on qualities like taste, fat content or bean size — what is called the “country differential.”

“At least if [the price on the global market] came in at a certain level where the farmer would always be comfortable enough to still produce and the buyer would also be able to afford [cocoa], we could sustain this,” Boafo told DW. “But in this situation, where the market is not working in the interest of the cocoa farmer, it becomes difficult for the sustainability of the industry.”

Oxfam’s study reveals that cocoa buyers simply reduced the country differentials for Ivory Coast and Ghana after these countries had introduced the $400 premium to support farmers.

No more chocolate?

Meanwhile, another major crisis is already brewing on the cocoa horizon in these two leading producer countries: production levels have gone down drastically in recent years.

Ghana produced about 750,000 metric tons of cocoa beans in the crop season between 2021 and 2022. However, production has dropped sharply since then. Ghana’s cocoa output for the season between 2023 and 2024 is now expected to be down by almost 40%.

Boafo said this bean shortage was the reason recent prices exceeded $10,000 per ton on the world market.

Asiedu explained that in addition to not fetching fair prices for cocoa beans, the sector also faces serious threats from climate change and other factors.

“We now have unusual rainfall, unusual sunshine, and sometimes you cannot predict this. We also have quite a number of [other] issues, like diseases, which farmers would have to control,” he told DW. “And sometimes access to chemicals to combat [diseases] also becomes an issue.”

Boafo added that smart farming methods needed to be adopted to protect the sector and fight global warming. “Climate change is a major concern,” he said. It is key that we are able to deal with its effects.”

But whether the issue is climate change, commodity prices, pests, output rates or incentives to continue the cocoa trade, it would appear that the countries that produce the precious beans don’t have much power to influence the price outcome.

That power, it seems, lies almost exclusively with the chocolate buyers and their middlemen.